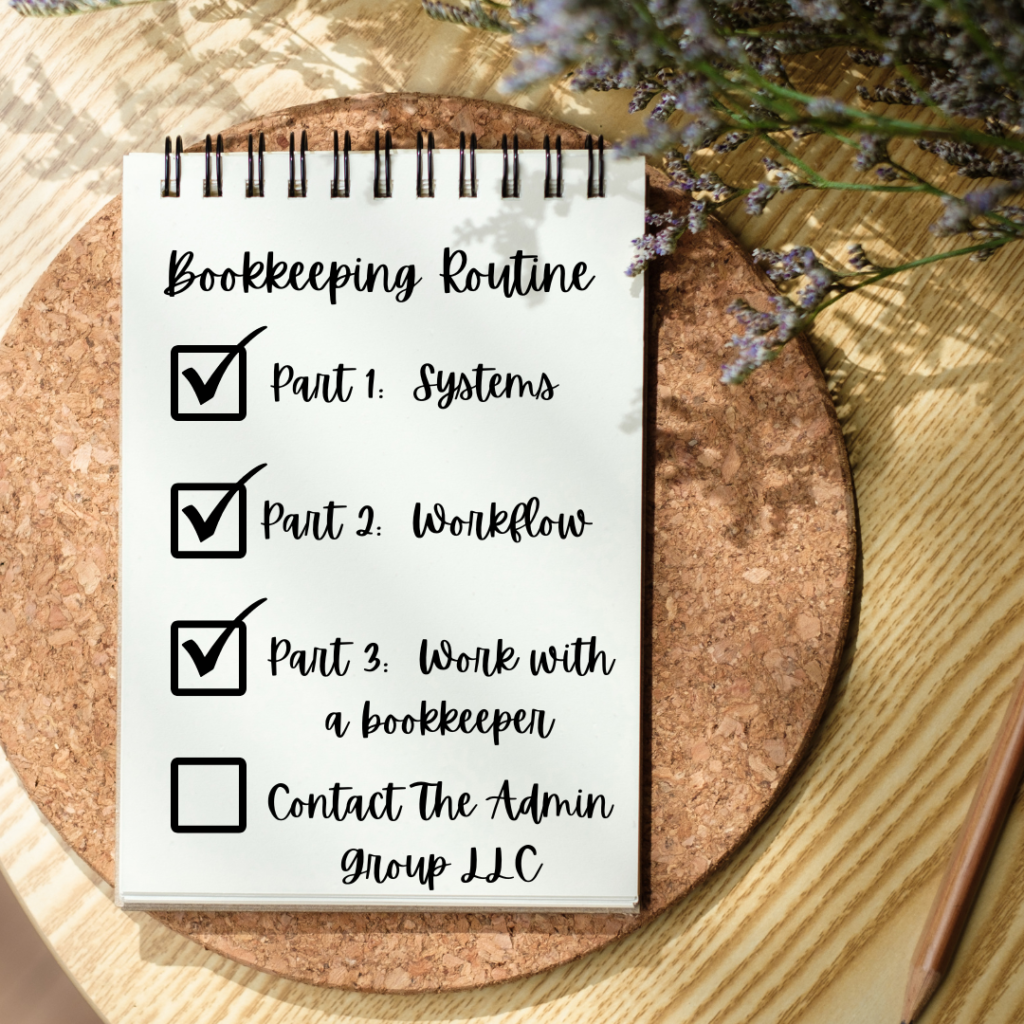

Creating a Bookkeeping Routine Part 3: Working with a Bookkeeper

So we’ve talked about the systems you need in place (Part 1), and we’ve talked about bringing those systems together to build a bookkeeping routine (Part 2). But have you ever wondered how your routine might evolve with the support of a bookkeeper? If you’re curious about the “why” behind working with a bookkeeper, you can find insights in our dedicated post HERE.

Now let’s dive into what your bookkeeping routine could entail when collaborating with a bookkeeper. Naturally, the routine will vary depending on the services your bookkeeper offers and what package level you select. In most cases, you’ll find bookkeepers offering one or more of these types of packages: Support for DIYers, general bookkeeping, and full-service bookkeeping. Below we’ll briefly discuss what each level of service entails, and how it affects your routine.

Support of DIYers

This level of service is designed for small business owners who plan to do their own bookkeeping. It will offer varying levels of support, from having an expert bookkeeper review your books on a routine basis to support calls and training in group calls or 1:1 with the bookkeeper.

When it comes to your routine, it won’t change significantly, but it will reduce your overall stress throughout the year, especially come tax time.

The workflow: You perform your full bookkeeping routine as discussed in Part 2 and in our downloadable bookkeeping routine builder (e.g., gathering information, categorizing transactions, and reconciling accounts, to list just a few) > you alert your bookkeeper monthly or quarterly (depending on what your package includes) when you are done and provide them any notes or questions you have > Your bookkeeper reviews your bookkeeping file and alerts you of any errors or things you missed so you can fix it ASAP.

At this point, they may also offer 1:1 meetings to review issues or group calls for additional Q&A and troubleshooting. And the biggest benefit of opting for a service like this if you want to DIY your books is knowing that come tax season, you won’t be the one stressing. While all your fellow DIYing small business owners are in a panic because their books are a mess, or their tax guy has to charge extra to sort through the chaos, you get peace of mind knowing you’ve kept up with your books AND had it all reviewed by an expert.

*At The Admin Group LLC, we offer this level of service! We call it The CheckIn.

General Bookkeeping

This is the most common level of service you’ll find offered by bookkeepers. With this service, the bookkeeper handles all the basic bookkeeping needs. When you move up to general bookkeeping, you’ll see a big impact on your routine.

The workflow: You process your invoicing & bill payments, track business mileage, and gather all the information your bookkeeper needs > The bookkeeper processes all the financial data in your bookkeeping platform and organizes the information. They handle the tedious work and only bring you in if there are specific questions they can’t answer > You respond to their questions (if needed) > They wrap up the books, make sure everything is balanced, and provide you with financial statements.

At this point, a good bookkeeper will offer a 1:1 meeting, either monthly or quarterly, to review everything. A financial or business expert will also include financial or business advice based on what they saw.

*At The Admin Group LLC, we offer this level of service! We call it The Game Changer.

Full-Service Bookkeeping

This level of service is everything you’ll find in general bookkeeping PLUS, managing things like your AP (Accounts Payable, aka bill payment) & AR (Accounts Receivable, aka invoice management), and payroll. How deep they dive into these areas may vary, but a full-service bookkeeper does play a more active role in many of these tasks.

Your workflow will vary greatly with this type of package depending on how much control you want to give the bookkeeper and the type of industry you are in. Because of this, we won’t dive into what the workflow would look like. However, we do want to touch on a very critical point.

At The Admin Group LLC, we intentionally do not offer this level of service because we believe that the person who has the ability to issue payments and direct control of your funds should not be the same person recording everything. After a decade in the financial industry, we have uncovered unfortunate situations where a trusted person (such as a bookkeeper, significant other, close friend, or family member) starts sending themselves money through a business owner’s account, but makes it look like the payment went to a legit bill. Because this separation of duties is something we feel strongly about, we’ve opted not to offer these extra services and instead choose to work with you and whomever you elect to handle these duties to verify things are being done correctly and in a way that your funds stay protected.

With that being said, we strongly encourage small business owners to make the choice of working with a bookkeeper at whatever level of service makes the most sense with where you are right now.

Are you strapped for cash, or not quite ready to let someone else manage your books? Then finding support from an expert is the way to go!

If you recognize that your time is valuable and you’d rather have the peace of mind knowing that someone else will take care of the tedious work so you can focus on the big picture, then general bookkeeping services or full-service may be in your sights.

Schedule a call with us and see which level of service is right for you.